Get the free public partnerships w 2 forms

Show details

MAIL TO: FAX No.: Place picture ID Here and photocopy this form PUBLIC PARTNERSHIPS, LLC ATTN: W2 UNIT 6 ADMIRALS WAY CHELSEA, MA 02150-4059 **We cannot reissue a form without a copy of valid identification**

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your public partnerships w 2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your public partnerships w 2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit public partnerships w 2 forms online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit public partnerships w2 online form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

How to fill out public partnerships w 2

How to fill out state return mail:

01

Gather all necessary documents, such as W-2 forms, 1099 forms, and any relevant receipts.

02

Determine which state tax forms are required for your specific situation. You can usually find these forms on the state's Department of Revenue website.

03

Obtain a copy of the instructions for the state tax forms you are using. These instructions will provide helpful guidance on how to properly fill out each section of the form.

04

Carefully review the instructions and fill out the state tax form, following all specified guidelines and providing accurate information.

05

Double-check all the information you have entered on the form before submitting it. Make sure to review your calculations and ensure everything is correct.

06

Sign and date the state tax form as required.

07

Make a copy of the completed state tax form and any supporting documents for your records.

08

Prepare the state return mail by placing the completed form and any additional documentation in an envelope.

09

Address the envelope to the appropriate state tax agency. The address can usually be found on the state's Department of Revenue website or in the instructions for the tax form.

10

Affix the necessary postage to the envelope and send it via mail or any preferred method.

Who needs state return mail?

01

Individuals who are required to file state income tax returns.

02

Individuals who have earned income in a particular state and need to report it to the state tax authorities.

03

Business owners who have conducted business activities in a specific state and are required to file state tax returns.

Video instructions and help with filling out and completing public partnerships w 2 forms

Instructions and Help about tax card form

Fill w2 public partnerships : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is state return mail?

State return mail refers to mail that is sent to individuals by their respective state tax authorities regarding their state income tax return. This typically includes important documents such as tax refund checks, notices of adjustment, requests for additional information, and other correspondence related to state tax filings.

How to fill out state return mail?

Filling out a state tax return by mail generally involves the following steps:

1. Obtain the necessary forms: Visit your state's tax department website or call their helpline to request the required forms for filing a state tax return by mail. These forms are typically available for download on the website as well.

2. Gather supporting documents: Collect all the necessary documents that are relevant to your state tax return. This may include W-2 forms, 1099 forms, receipts for deductions or credits, and any other relevant income or expense documentation.

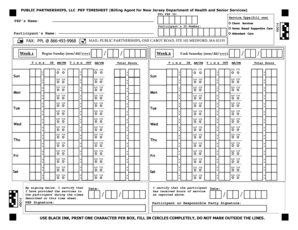

3. Fill out the forms: Carefully complete the state tax return form(s) using black ink or as instructed on the forms. Ensure that you provide all requested information accurately, double-checking for errors and omissions.

4. Attach supporting documents: Attach any supporting documents required by your state, such as copies of W-2s, schedules, or other evidence of income or deductions. Be sure to organize and label them appropriately.

5. Calculate your state tax liability: Use the provided instructions to determine your state tax liability or refund amount. Enter this information accurately on the appropriate line of the form.

6. Include payment, if applicable: If you owe state taxes, enclose a check or money order for the amount due. Make it payable to the appropriate state tax authority. Ensure you follow any instructions regarding payment and include the payment voucher, if required.

7. Review and sign: Carefully review all the information you have entered, ensuring its accuracy. Sign and date the return as required.

8. Make copies: It's a good practice to make copies of your fully filled-out state tax return, all supporting documents, and the check or money order payment for your records.

9. Send the return: Once you have completed the previous steps, place everything in an envelope and address it to the appropriate state tax department. Use certified mail or a similar method to ensure its delivery and keep a record of the receipt.

Note: The specific process may vary depending on your state and its requirements. Always refer to your state's tax department website or consult professional help to get accurate and up-to-date information.

What is the purpose of state return mail?

The purpose of state return mail is to ensure that official documents, correspondence, or notices sent by the government or organizations are received and processed by the intended recipients. It allows individuals or businesses to respond, take necessary actions, or provide requested information related to their state-level taxes, legal matters, registration, licensing, or other government-related processes. State return mail is typically used as a method of communication between the government and taxpayers or citizens to facilitate important exchanges of information or documentation.

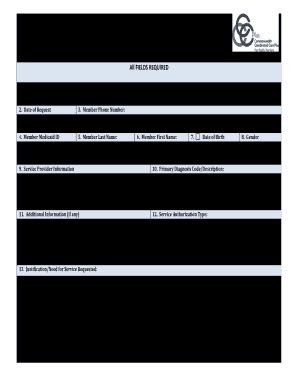

What information must be reported on state return mail?

The information that must be reported on a state return mail may vary depending on the specific state and its tax regulations. However, generally, the following information may need to be reported:

1. Taxpayer's personal details: This includes the taxpayer's full name, mailing address, Social Security number or taxpayer identification number.

2. Filing status: Indicate the taxpayer's filing status (single, married filing jointly, married filing separately, head of household, etc.).

3. Income details: Report all sources of income earned within the state, such as wages, self-employment income, rental income, investment income, etc. Include copies of W-2s, 1099 forms, and any other supporting documentation.

4. State-specific deductions and credits: Some states offer specific deductions and credits that may need to be reported, such as education expenses, homeownership expenses, child and dependent care expenses, etc. Provide all supporting documentation for these deductions or credits.

5. Taxes paid: Report any taxes already paid to the state, including estimated tax payments, withholding from wages, or any other taxes withheld.

6. Tax calculations: Calculate the tax owed or the refund due based on the state's tax rates and brackets.

7. Signature: Sign and date the return to certify its accuracy and completeness.

8. Any other state-specific requirements: Some states may have additional requirements or forms that need to be included in the state return.

It is important to consult the specific state's tax agency website or contact a tax professional to ensure compliance with all reporting requirements for filing a state return.

What is the penalty for the late filing of state return mail?

The penalty for late filing of a state return by mail varies depending on the state and its specific tax laws. In most cases, the penalty is typically a percentage of the unpaid tax amount or a flat fee per month or part of a month that the return is late. However, it is important to consult the specific tax laws of the state in question to determine the exact penalty for the late filing of a state return.

Can I create an eSignature for the public partnerships w 2 forms in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your public partnerships w2 online form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out w2 public printable using my mobile device?

Use the pdfFiller mobile app to fill out and sign state return mail. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Can I edit w2 public search on an Android device?

With the pdfFiller Android app, you can edit, sign, and share foreign return tax form on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your public partnerships w 2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

w2 Public Printable is not the form you're looking for?Search for another form here.

Keywords relevant to w2 public blank form

Related to w2 public pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.